Sustainability Insights: Beyond DEI Backlash: TISFD Ignites the Social Resilience Measurement Battle

Sustainability now requires concrete results and performance beyond advocacy. As global sustainable development progresses, mere information disclosure fails to satisfy stakeholders. Businesses must tackle complex issues like inequality, just transition, and social resilience.

Our article, "'Sustainable Inflation Era' Arriving?! 7 Key Points for Sustainable Leaders to Watch in 2024," highlights the trend: businesses are now prioritizing the 'Social' aspect of ESG, shifting focus from 'Justice' to 'Social and Justice.' Despite challenges to DEI (Diversity, Equity, and Inclusion), addressing social issues and just transition topics remains crucial. The Taskforce on Inequality and Social-related Financial Disclosures (TISFD) will be key in guiding us to prioritize people and tackle current and future challenges.

At the 2024 G20 Summit in Rio de Janeiro, leaders highlighted that inequality is central to global challenges and worsens them. It reduces human capital, erodes social capital, lowers demand and investment, stifles competition, and hampers economic growth. This renewed focus underscores the importance of social equity and justice in sustainable development.

The Third Universe of T-x-FD Takes Shape! TISFD's "Focusing on People" Strategic Vision

Global attention on Diversity, Equity, and Inclusion (DEI) is facing resistance. Companies are cautious about DEI policies, and some regions show resistance to related initiatives, affecting investment and progress in social equity. This backlash stems from economic downturns, controversies over DEI methods, employee psychological pressures, and political or cultural conservatism. In this context, the establishment of TISFD and its inclusion of the social dimension is a significant step forward.

(Key Development Areas of TISFD/Image: CY. (Richard), Chen)

(Key Development Areas of TISFD/Image: CY. (Richard), Chen)

The Task Force on Climate-related Financial Disclosures (TCFD) assists organizations in identifying climate change risks and opportunities, while the Taskforce on Nature-related Financial Disclosures (TNFD) expands its focus to natural capital. The development of TISFD, however, will explicitly center on the human context, concentrating its core issues on the following six key areas:

- Well-being

Well-being includes health, income, social connections, knowledge, and skills. Inequality means disparities in well-being, which are interconnected. For businesses, employee well-being affects productivity, innovation, and turnover. Community well-being impacts the business environment and social acceptance. - Human Rights

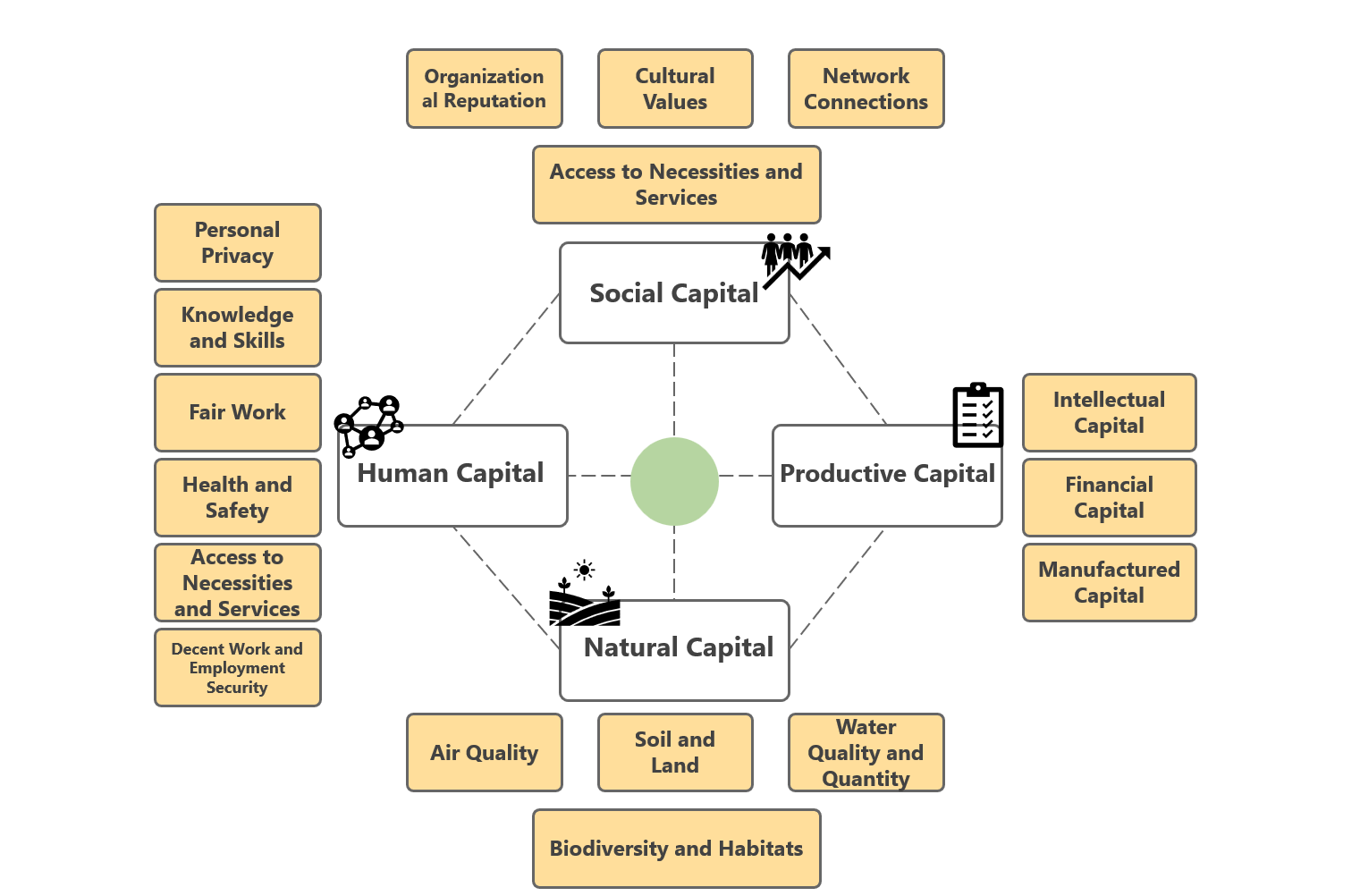

Human rights are fundamental to individual dignity. Organizations must respect them, avoid violations, and address any harm from their operations. This requires due diligence in supply chain management, product development, and technology use. Organizations should disclose human rights risks, provide grievance mechanisms, and protect stakeholder rights. This aligns with global standards like the UNGPs and the OECD MNE Guidelines. - Human and Social Capital

Human and social capital can be viewed in terms of resources' stock and flow. This helps reconsider how people generate value for organizations and society, promoting a sustainable framework focused on well-being and human rights.

(Definitions and Categories of the Four Common Types of Capital/Image: SC. (Tracy), Ni)

(Definitions and Categories of the Four Common Types of Capital/Image: SC. (Tracy), Ni)

- Human Capital: This term refers to individuals' intangible assets like knowledge, skills, abilities, and characteristics, which drive organizational competitiveness. According to the World Bank, human capital makes up over 60% of global wealth, double that of produced capital, highlighting the importance of people to societal functioning. Post-pandemic, shifts in work patterns, digitalization pressures, and economic uncertainty have made employee well-being a priority. Organizations are now using ISO 45003 guidelines to manage workplace psychological health, boosting resilience and competitiveness.

- Social Capital: Resources formed between individuals or organizations through trust, reciprocity, and networks. These include shared norms, values, and understandings that aid cooperation within or between groups. For businesses, good relationships with suppliers, customers, and stakeholders reduce costs, create opportunities, and strengthen their "social license to operate." Trust, social cohesion, and stable institutions are essential for a market economy's smooth functioning and support the operations of organizations and financial institutions.

- Inequalities

Inequality refers to disparities in people's conditions, including differences in well-being such as income, wealth, and health. It not only reflects the difficult living conditions of some populations but also signifies the concentration of resources in the hands of a few highly advantaged individuals and organizations, and is a driver of further impacts and risks. When inequality reaches significant levels and accumulates both within and across societies, it has been shown to negatively affect social and economic stability, thereby impacting organizations and financial institutions. - Affected Stakeholders

The relationship between affected stakeholders and an organization can, in turn, become a source of risks and opportunities. In the context of sustainability measurement and reporting, the four main key stakeholders currently considered from an impact and risk management perspective include:- The organization's own workforce: This includes both direct employees and non-employee workers of the organization

- Workers in the value chain: This includes entities both upstream (suppliers) and downstream.

- Consumers and end-users: Other individuals affected by products and services.

- Communities: This includes communities affected by the organization's own operations and its value chain.

-

Public Institutions & the Economy

Public institutions can influence how organizations impact society. The quality and integrity of these institutions, shaped by organizational actions like lobbying and tax strategies, can affect human and social capital positively or negatively. For instance, such actions can influence government support for education, health, law, property rights, and public R&D investment. However, they may also lead to inequality if they do not promote fair and sustainable policies.

From Headwinds to Turning Point: TISFD Reshapes Corporate Sustainability Value with the IDROs Model

Despite challenges, the evolution of social impact measurement is inevitable. TISFD's strategy focuses on people and assesses social issues' impact on corporate operations through "Impacts," "Dependencies," and "Risks and Opportunities" (IDROs). This framework guides key social constructs analysis and materiality methodology recommendations while highlighting the link between inequality, social issues, climate change, and nature loss. It underscores TISFD's importance to capital providers.

Supply chain disruptions due to climate change, reputation crises from labor rights disputes, or social instability from wealth disparities can affect an organization's financial performance and viability. Dependency on the workforce may lead to labor shortages, a risk that impacts negatively if not managed. Investing in employee training can create opportunities and positive social impacts. Dependencies on natural resources can affect local communities' livelihoods, leading to human rights risks if mismanaged.

.png) (IDROs Model/Image: CY. (Richard), Chen)

(IDROs Model/Image: CY. (Richard), Chen)

Currently, organizations and financial institutions often struggle to effectively identify, assess, and disclose these crucial social issues. The absence of a consistent model and comparable data makes decision-making difficult for investors and hinders organizations from effectively managing their risks. TISFD's mission is precisely to bridge this gap. To achieve this, its four global Regional Councils will work in the following ways:

- Establish a Solid Conceptual Foundation

TISFD will define the IDROs model for "people," ensuring unified terminology and classification standards. This aims to clear up any conceptual ambiguity and improve information disclosure quality. - Dialectical Foundational Research

TISFD will support research on social issues by collecting data and case studies. This aims to show the impact of social issues on corporate value and provide evidence for policy-making. - Develop key indicators

TISFD will create practical social metrics in areas like well-being, human rights, and social capital. These will help organizations and financial institutions assess their social performance effectively, offering clear guidelines for measuring social impact. - Address data challenges

TISFD aims to improve social data collection and analysis by using technologies like AI and blockchain to enhance accuracy and transparency. It will also explore non-traditional data for a broader understanding of social impact.

From Compliance to Empowerment: Making "People-Centric Sustainability" a Core Business Strategy

Investors now prioritize non-financial information, regulators enforce stricter social responsibility standards, and consumers demand higher ethical practices. This compels organizations to manage their social impact more carefully. Social impact measurement has become essential for organizational survival, driven by sustainable development, re-pricing of risks and opportunities in capital markets, and evolving public expectations.

TISFD values social capital as equally important as natural and climate capital, integrating it into their strategic priorities alongside environmental concerns. Rooted in global norms recognized by governments, the TISFD framework emphasizes the need for organizations and financial institutions to respect human rights. Rather than championing a "zero-sum game," we acknowledge that without upward mobility and stability for all, political and economic systems weaken, causing global and social instability.

People are the core of sustainable development. Prioritizing "people" in organizations expands their value beyond finances to societal well-being. Leaders must ensure their entities follow "people-centric sustainability." Focus on these three key aspects for social impact measurement and management:

- Strategically Integrate Social Capital, Rather Than Merely Complying with Reporting

Organizations should integrate human and social capital into their core strategies, including well-being, human rights, and labor considerations in product design, supply chain management, and talent development. This approach creates business value, treating social impact measurement as a strategic investment rather than a compliance cost. - Embrace Data and Transparency to Enhance Social Impact Visibility

The development of frameworks like TISFD will make social issue disclosures more accurate and thorough. Organizations should invest in systems for collecting, analyzing, and managing social data, and disclose information transparently. This improves management and meets the expectations of stakeholders, turning data into actionable insights and making social impact visible. - Deepen Collaboration and Innovation to Co-create a Resilient Social Ecosystem

Solving social problems requires collaboration beyond a single organization. Organizations should partner with non-profits, academia, government agencies, and peers to find innovative solutions. Cross-sector collaboration allows us to combine resources and expertise to tackle systemic risks, transitioning from isolated efforts to collective action for a more equitable, inclusive, and resilient social ecosystem.

Despite global uncertainties, social impact measurement will keep advancing businesses and society. TISFD guides organizations to "focus on people" and manage their IDROs. By building a solid foundation, promoting research, developing metrics, and addressing data challenges, we can collectively tackle systemic inequality risks.

Sub-editing: SC. (Tracy) Ni

Further Reading

Sustainability Insight: T-x-FD’s Universe Emerges: TISFD’s Social Disclosure Storm Challenges Five Major Industries

Sustainability Insight: Great Power Games, Small Country Adaptations’ - Sustainability Transition Enters a New Phase! Slow Down or Stall? 5 Key Points to Watch for Sustainability Leadership in 2025